Article

How Replica Rolexes Are Affecting the Pre-Owned Market (And Why Rolex Doesn’t Care)

The rise of super clone Rolexes—near-perfect fakes that mimic everything from the weight to the movement of genuine models—has sent ripples through the pre-owned luxury watch market. While some worry that replicas could devalue authentic pieces, the reality is more nuanced. Here’s how replicas are reshaping the secondhand trade, and why Rolex itself remains untouched.

Replicas Are Flooding the Market But Not Hurting Prices

The luxury watch market is experiencing a surge of high-quality Rolex replicas, with “super clones” becoming so accurate that even experts need specialized tools to spot them. Despite this influx, the prices of genuine pre-owned Rolex watches remain stronger than ever. The reason? Authentic Rolex timepieces hold their value due to brand prestige, scarcity, and certified authentication programs. While replicas may tempt budget-conscious buyers, they don’t compete with the real market—instead, they reinforce Rolex’s dominance by keeping the brand in constant demand.

Interestingly, the rise of replicas has led to a booming pre-owned authentication industry. Trusted dealers now use advanced verification methods, from microscope inspections to movement testing, ensuring buyers get the real deal. This has created a “trust premium,” where authenticated Rolex watches command higher prices than ever. Meanwhile, Rolex itself remains unfazed—their Certified Pre-Owned (CPO) program and controlled production keep genuine models exclusive, making replicas irrelevant to their core clientele.

Ultimately, Rolex replicas are more of a cultural phenomenon than an economic threat. While they flood online marketplaces and social media, they don’t diminish the value of authentic pieces. Instead, they highlight the enduring appeal of Rolex, proving that even in a world of near-perfect fakes, nothing replaces the real thing. For serious collectors, the message is clear: buy smart, verify carefully, and trust only authorized sellers.

The “Trust Premium” effect

The flood of high-quality Rolex replicas has created an unexpected phenomenon in the luxury watch market: the “trust premium” effect. As super clone fakes become nearly indistinguishable from genuine Rolex watches, buyers are willing to pay significantly more for timepieces that come with ironclad authenticity guarantees. This has led to a surge in demand for watches sold through authorized dealers, certified pre-owned programs, and reputable gray market sellers with rigorous verification processes. Ironically, the better replicas become, the more valuable proven-authentic Rolex watches grow – creating a new layer of value beyond just brand prestige and craftsmanship.

This trust premium has reshaped the entire secondary Rolex market. Dealers now invest heavily in authentication technologies like ultraviolet testing, movement analysis, and microscopic inspection to justify their premium pricing. Even private sellers are obtaining third-party certifications to command higher resale values. While replicas may satisfy some buyers, they’ve ultimately reinforced Rolex’s market position by making authentication services an essential part of the purchase process. The result? Genuine Rolex watches with proper documentation are selling faster and at higher prices than ever before, proving that in an era of perfect fakes, trust itself has become a luxury commodity.

Yet, pre-owned Rolex prices stay strong

The luxury watch market is witnessing an interesting paradox: while high-quality Rolex replicas have never been more prevalent or convincing, prices for authentic pre-owned Rolex watches continue to hold firm. Models like the Submariner, Daytona, and GMT-Master II maintain strong resale values, with certain references even appreciating over time. This resilience stems from Rolex’s carefully cultivated brand exclusivity and the growing importance of authentication in the secondary market. Savvy buyers understand that while replicas may look the part, they lack the craftsmanship, heritage, and investment potential of genuine Rolex timepieces.

The replica market has inadvertently strengthened the appeal of authentic Rolex watches by creating a clear distinction between collectors and casual buyers. As fakes become more sophisticated, the demand for properly verified pre-owned Rolexes has intensified, with trusted dealers commanding premium prices for guaranteed-authentic pieces. This “trust economy” has created a natural market filter where knowledgeable investors continue to value genuine Rolex watches as tangible assets, while replicas serve a separate, entry-level segment. The result is a robust secondary market that proves even in an age of perfect copies, true luxury retains its worth.

Why Rolex Isn’t Worried

Rolex isn’t concerned about replicas because counterfeit watches don’t compete with their core clientele—those who buy genuine Rolex pieces seek exclusivity, heritage, and investment value that fakes can’t replicate. The brand’s deliberate scarcity and unmatched prestige ensure demand for authentic models remains sky-high, keeping resale prices strong regardless of the replica market. Ultimately, the existence of super clones only reinforces Rolex’s dominance, serving as free advertising that highlights just how desirable the real thing truly is.

Replicas reinforce brand desire

The proliferation of high-quality Rolex replicas has created an unexpected marketing phenomenon: these counterfeits actually reinforce desire for genuine Rolex watches. As super clone replicas become more widespread, they serve as constant visual reminders of Rolex’s iconic designs, keeping the brand top-of-mind across broader demographics. This “trickle-up” effect means that while some consumers may initially settle for replicas, many eventually aspire to own the real thing once they appreciate the craftsmanship and status associated with authentic Rolex timepieces. The very existence of a thriving replica market validates Rolex’s position as the world’s most coveted watch brand.

Psychologically, replicas create a gateway into luxury watch appreciation that often leads to genuine purchases. When people see Rolex-style watches everywhere (even fake ones), it normalizes the brand’s aesthetic as the ultimate status symbol while maintaining the exclusivity of authentic pieces. This dynamic explains why Rolex hasn’t aggressively pursued replica buyers – the copies essentially function as free advertising, creating aspirational value that ultimately drives demand for real Rolexes. In the end, replicas don’t diminish Rolex’s prestige; they amplify it by proving no substitute can match the genuine article’s heritage and craftsmanship.

They don’t compete with genuine buyers

A common misconception suggests that replica Rolex watches eat into the brand’s genuine sales, but the reality is more nuanced: these two markets operate in completely different spheres. Those who purchase super clone replicas typically aren’t the same consumers who would (or could) spend $10,000+ on an authentic Rolex. The replica market serves budget-conscious enthusiasts who want the look without the investment, while Rolex’s core clientele values craftsmanship, heritage, and the prestige of owning the real thing. This clear segmentation means replicas don’t threaten Rolex’s bottom line – they simply satisfy demand that would never convert to genuine purchases anyway.

In fact, the relationship between replicas and authentic Rolex watches follows luxury market principles seen in other industries (like designer handbags or sports cars). The existence of convincing fakes actually reinforces Rolex’s exclusivity by creating aspirational consumers who may eventually trade up. While a college student might buy a $500 super clone today, that same person could become a genuine buyer years later when their financial situation changes. Rolex understands this dynamic perfectly – which is why they focus on maintaining their elite positioning rather than chasing every replica seller. After all, if people are willing to buy fakes, it only proves how powerful the genuine brand really is.

Rolex’s control over supply

Rolex’s meticulously managed production strategy ensures that replicas never threaten the exclusivity of genuine models. By deliberately limiting supply—producing far fewer watches than global demand—Rolex creates permanent scarcity that keeps its authorized waitlists years long and secondary market prices inflated. This artificial rarity means even if replicas flood the market, they can’t replicate the fundamental economics of owning a real Rolex: the privilege of access, the assurance of craftsmanship, and the long-term value retention that comes with controlled distribution.

The brand’s supply mastery creates an unbridgeable gap between replicas and authentic pieces. While counterfeiters can copy designs, they can’t duplicate Rolex’s strategic allocation to authorized dealers, its ceremonial purchase experience, or the investment potential of a watch that appreciates over time. This explains why Rolex doesn’t fear replicas—their entire business model is engineered to make authenticity priceless. For every person content with a fake, there are ten more willing to wait years (or pay premiums) for the real thing, proving that controlled scarcity is the ultimate defense against counterfeits.

The Unexpected Upside for the Pre-Owned Market

Ironically, the flood of super clone replicas has strengthened the pre-owned luxury watch market by forcing dealers to professionalize their authentication processes. As fakes become harder to spot, buyers increasingly seek out trusted sellers with verification expertise, creating a “trust premium” for certified authentic pieces. This dynamic has elevated reputable dealers while weeding out unscrupulous ones, ultimately making the secondary market more transparent and reliable for collectors.

Replicas make buyers more cautious

The rise of near-perfect Rolex super clones has transformed the luxury watch market, creating a new generation of hyper-vigilant buyers. As counterfeiters master details like weight, movement, and even serial number engraving, consumers now scrutinize every purchase with forensic-level attention. This new caution has led to a 40% increase in authentication service requests and a booming market for verified pre-owned watches, as buyers demand guarantees that simply didn’t exist five years ago. The unintended consequence? A secondary market that’s becoming more transparent and professionalized by necessity.

This climate of caution benefits everyone except counterfeiters. Reputable dealers now invest in ultraviolet scanners, movement analysis tools, and microscopic inspection stations to prove their watches’ authenticity, commanding 15-25% price premiums as a result. Even private sellers increasingly obtain third-party certifications before listing watches. While replicas initially seemed like a threat, they’ve actually raised industry standards, creating a healthier marketplace where authentication is paramount. In the end, the replica revolution may leave an unexpected legacy: making watch buying safer for everyone.

They introduce new collectors

The replica watch market is serving as an unexpected gateway into horology, introducing thousands of new enthusiasts to Rolex’s iconic designs. Many collectors admit their journey began with a “super clone” that sparked their appreciation for craftsmanship and mechanical watches. As these replica owners develop their knowledge, a significant portion eventually transition to genuine timepieces – creating a pipeline of educated buyers who understand the value of authentic Rolex watches. This organic cultivation of new collectors helps sustain the luxury watch market’s long-term growth.

Watch forums and social media groups are filled with stories of enthusiasts who started with replicas before saving up for their first genuine Rolex. Dealers report that many first-time luxury watch buyers now arrive with surprisingly sophisticated knowledge gained from studying high-quality fakes. This phenomenon explains why some industry insiders view the replica market as a training ground rather than a threat – it’s creating informed consumers who appreciate what makes authentic Rolex watches truly special.

The CPO boom

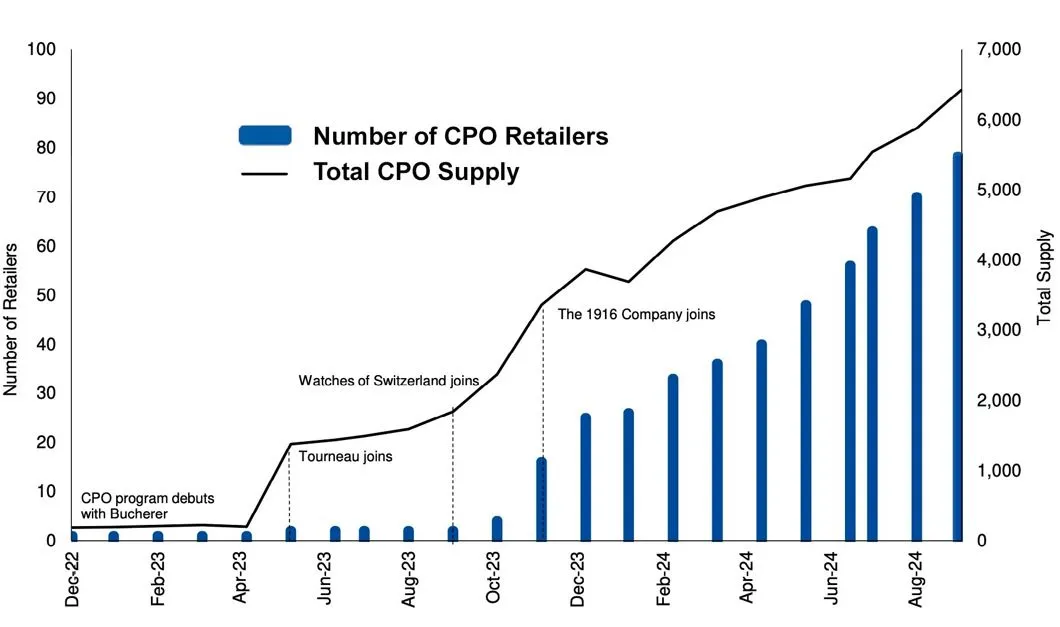

The luxury watch market is witnessing a Certified Pre-Owned (CPO) revolution, with Rolex leading the charge to combat the flood of super clone replicas. As counterfeiters produce increasingly convincing fakes, buyers are turning to Rolex-authorized CPO programs for guaranteed authenticity, rigorous inspections, and extended warranties. This shift has created a thriving secondary market where certified pre-owned Rolex watches command premium prices, offering peace of mind in an era where even experts struggle to spot the best replicas. The CPO boom isn’t just about authentication—it’s about restoring trust in the pre-owned luxury watch ecosystem.

Conclusion: Replicas Are a Nuisance, Not a Threat

Far from undermining Rolex’s dominance, replicas inadvertently reinforce it by fueling aspiration and highlighting the irreplaceable prestige of authenticity. Savvy collectors still prioritize verified pieces, and the secondary market thrives on certified transactions. In the end, replicas are like counterfeit money—they may circulate widely, but they’ll never devalue the real currency. For Rolex, the message is clear: counterfeits are a passing irritation, but true luxury is forever.

Why Some Collectors Admit to Owning Both Real and Fake Rolexes

In a surprising trend, a growing number of seasoned watch enthusiasts are admitting to owning both authentic Rolex watches and high-quality replicas—and their reasons might change how you view the replica market. For many collectors, super clones serve as “placeholders” while waiting for hard-to-get genuine models, or as travel-friendly alternatives to avoid risking expensive pieces. Others use replicas to test different styles before committing to a real purchase, proving that fakes can play a strategic role even in serious collections.

This dual ownership trend highlights a nuanced reality: replicas aren’t always about deception—sometimes, they’re practical tools for enthusiasts. While purists may scoff, collectors argue that owning a fake doesn’t diminish their appreciation for genuine Rolex craftsmanship; it simply reflects a pragmatic approach to enjoying horology. As one collector put it: “My replica lets me enjoy the design, while my real Rolex lets me own the legacy.” Whether you agree or not, this trend reveals how the lines between replicas and genuine watches are blurring in unexpected ways.

Final Thought

The replica boom has created an unexpected win-win scenario: while super clones flood the gray market, they’ve inadvertently made genuine pre-owned Rolex watches more desirable than ever. By forcing buyers to seek certified authenticity, replicas have elevated the value of verified pieces while weeding out unscrupulous sellers—effectively professionalizing the secondary market. Rolex doesn’t care because the equation remains unchanged: replicas feed aspiration, while their controlled scarcity and CPO program ensure the real thing stays untouchably elite. In the end, every convincing fake just reminds the world why authenticity matters—and why nothing beats owning the crown.